The Future of Accounting Careers: Job Prospects & Skills Needed in 2025, 100% Job, GST Certification Course in Delhi, Individual

2025-05-30 14:03 Learning New Delhi 15 views Reference: 249Location: New Delhi

Price: Free

The Future of Accounting Careers: Job Prospects & Skills Needed in 2025

Accounting careers in 2025 are set for robust growth, driven by business expansion, regulatory changes, and digital transformation. The demand for skilled professionals is rising across sectors such as banking, IT, manufacturing, healthcare, and retail, making accounting a future-proof career choice.

Job Prospects in 2025

-

High Demand Across Industries: Every business, from startups to multinationals, requires accountants for financial reporting, tax management, auditing, and compliance. This ensures career stability and flexibility.

-

Lucrative Roles: Top accounting jobs include Chartered Accountant (CA), Certified Public Accountant (CPA), Financial Analyst, Cost Accountant, Tax Consultant, Auditor, and Corporate Treasurer.

-

Attractive Salaries: CAs can earn ₹8–25 LPA, CPAs ₹10–30 LPA, and Financial Analysts ₹4.5–15 LPA, with higher earnings in metro cities and multinational firms.

-

Global Opportunities: Certifications like CPA and CMA (USA) open doors to international roles, especially as more Indian companies adopt global accounting standards.

Skills Needed for Success

-

Technical Proficiency: Mastery of accounting software (e.g., Tally, SAP FICO), GST compliance, and practical income tax return filing (ITR 1–7) are essential. Courses offering free SAP FICO certification, like those from SLA Consultants India in Delhi (110088), provide a competitive edge.

-

Regulatory Knowledge: Understanding of GST, the latest tax laws, and compliance requirements is crucial for roles in tax consultancy and auditing. GST Institute in Delhi

-

Analytical & Communication Skills: Accountants must analyze complex data, identify trends, and communicate findings to management for strategic decision-making.

-

Adaptability to Technology: Automation and AI are reshaping finance; professionals must stay updated with digital tools and ERP systems.

How Specialized Courses Help

Institutes in Delhi (110088), such as SLA Consultants India, offer:

-

100% Job Assistance: Strong placement support in top firms.

-

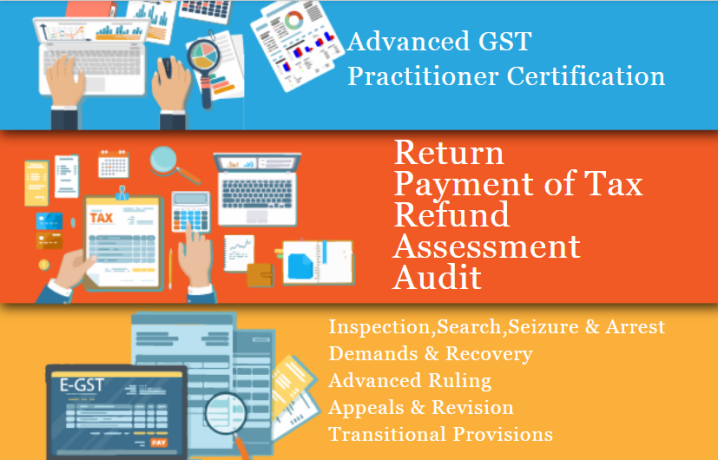

GST Certification: In-depth, practical training for GST registration, compliance, and return filing.

-

Free SAP FICO Certification: Equips students with in-demand ERP skills for large corporates.

-

Income Tax ITR 1 to 7 Practical Training: Real-world experience with e-filing and case studies, making graduates job-ready for tax and compliance roles.

Conclusion

The future of accounting is bright, with expanding job prospects, high salaries, and diverse career paths. By acquiring industry-relevant certifications—especially in GST, SAP FICO, and practical tax training—accounting professionals in 2025 will be highly sought after across industries, both in India and globally.

SLA Consultants The Future of Accounting Careers: Job Prospects & Skills Needed in 2025, 100% Job, GST Certification Course in Delhi, 110088 - Free SAP FICO Certification by SLA Consultants India, "Income Tax ITR 1 to 7 Practical Training" details with New Year Offer 2025 are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

E-Accounts, E-Taxation and (Goods and Services Tax) GST Training Courses

Module 1 - GST- Goods and Services Tax- By Chartered Accountant- (Indirect Tax)

Module 2 - Income Tax/TDS - By Chartered Accountant (Direct Tax)

Module 3 - Finalization of Balance sheet/ preparation of Financial Statement- By Chartered Accountant

Module 4 - Banking and Finance Instruments - By Chartered Accountant

Module 5 - Customs / Import and Export Procedures - By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar, New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/